George Business transfers your money quickly to accounts all around the world. In doing so, George differentiates between transfers within the SEPA area and foreign transfers (non-SEPA).

Last Article Update 20.11.2025

George Business transfers your money quickly to accounts all around the world. In doing so, George differentiates between transfers within the SEPA area and foreign transfers (non-SEPA).

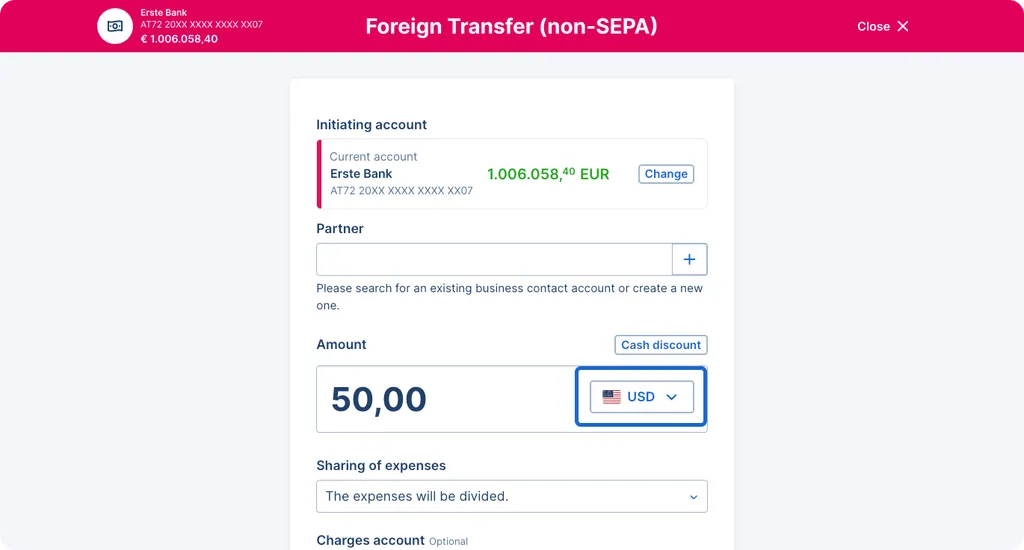

While preparing your transfer there are some things you should keep in mind so your money arrives at the desired destination, whether it's abroad or within the SEPA zone but in a currency other than EUR.

The Single Euro Payments Area (SEPA) currently consists of 41 countries, amongst them all 27 EU member states. SEPA's goal is to unify cashless payments in Euro amongst those within the area. A SEPA transfer works the same way as a domestic transfer. The country doesn't need to have EUR as a currency to take part in SEPA, as long as the transfer is done in EUR.

Of course, that means that if an international transfer even within the SEPA area is done in another currency than EUR, it automatically becomes a foreign transfer (non-SEPA). Also, transfers to countries outside of SEPA will always be foreign transfers (non-SEPA).

As of October 2025, the following countries are part of SEPA:

Please note that Greenland and the Faroe Islands are not part of the SEPA area. This also applies to Kosovo and Montenegro: though they do have the EURO as their countries' currency, they are not part of the SEPA area.

1. From your George Business overview, select "New Order" in left-side navigation.

Of course, you can also start a new order directly from one of your accounts, your account history, or by using Feature Assistant.

2. Select "Single Transfer" from the dropdown menu.

3. As when preparing a regular SEPA transfer, select the initiating (sender) account. If you initiated the transfer from your account history or from within an account, then this account will be automatically selected as the initiating account. Then the partner/recipient (from the contact list or by creating a new contact) and, of course, the amount.

4. George shows you additional fields for non-SEPA transfers:

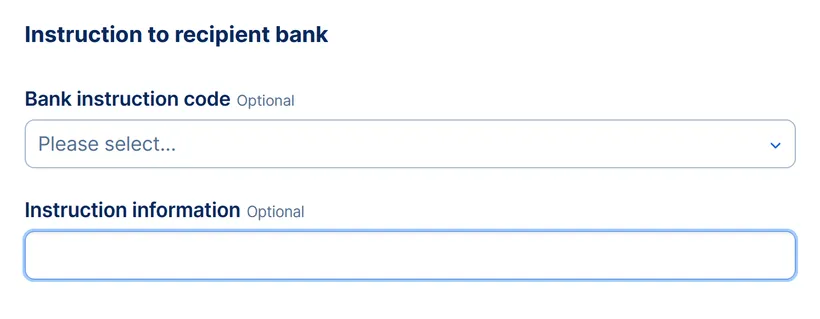

5. You can now add:

These fields are optional.

6. You can choose a transfer date - the default is today. Tick "Urgent Transfer" if you want the transfer to go through faster. This means extra costs, and is different from Instant Payments (SEPA).

7. When you click "More options", George shows you more optional fields:

In the case of cross-border transfers, the central bank of the recipient country may require a purpose code to be specified in order to enable the payment to be accepted and processed smoothly. This code is used to provide information about the type of payment and helps to monitor and regulate all cash flows within the country. This can apply to international transfers to countries such as China or the United Arab Emirates.

To add a purpose code to your payment, you can follow the steps below:

8. In the next step, you can either save this transfer for later, save the transfer and immediately prepare a new one, or sign it right away.

As mentioned above, in the amount field you can select foreign currencies other than EUR in which your foreign transfer (non-SEPA) shall be executed.

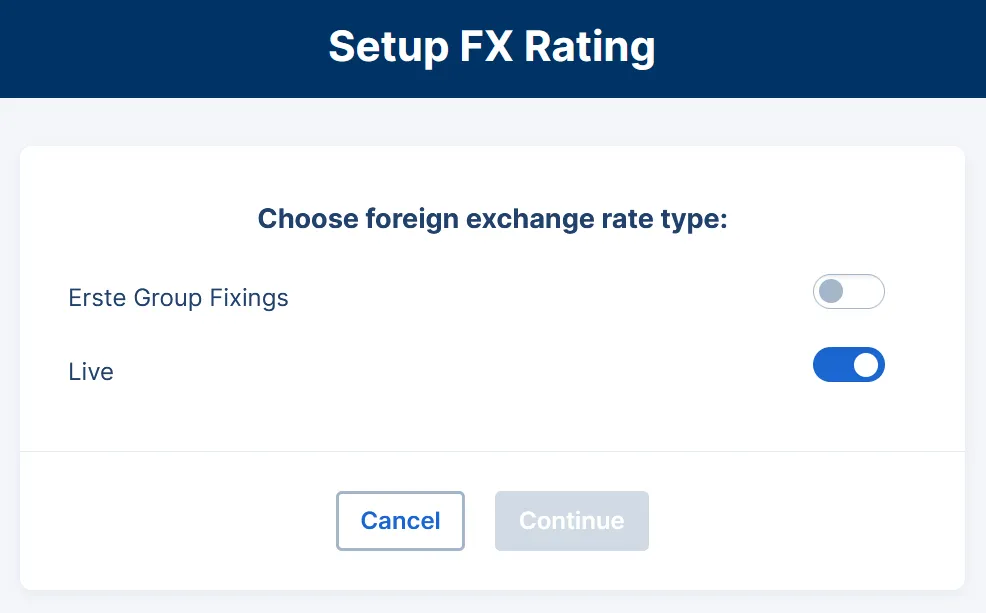

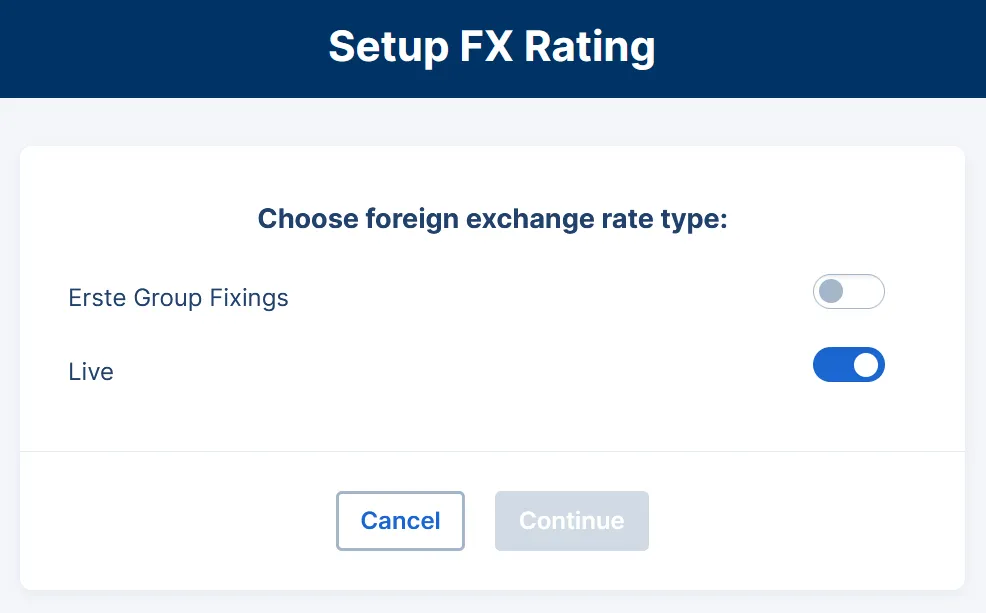

For orders in foreign currencies, a foreign currency conversion is generally necessary. Before you sign an order, George checks whether live rates are available. If there are no current rates, you can sign the order using the Erste Group Fixing or try again at a later date. The Erste Group Fixing rate is the daily rate for foreign currency payments.

For more information on the FX Live Rate, please expand the toggle below.

FX Live Rates are a way to sign non-SEPA transfers with a current rate.

In order to determine the live rate, the authorised signee must have the authorisation for live rates at George Business. Therefore, this setting is only available to you if you have been enabled for this function by your personal advisor. As an administrator, you can see whether a user has authorisation for transfers with the FX live rate in the user overview under the label "FX live rate" after clicking on "Permissions".

There, as an admin, you can either grant the permission for using the FX live rate or just stay with the Erste Group Fixing exchange rate.

For orders in foreign currencies, a foreign currency conversion is generally necessary. Before you sign an order, George checks whether live rates are available. If there are no current rates, you can sign the order using the Erste Group Fixing or try again at a later date. The Erste Group Fixing rate is the daily rate for foreign currency payments.

If you have a current rate available, you can select a disposer for signing. Then select your usual signing method. Click on "Next" to request the current live rate.

Important: You now have 55 seconds to fix this rate and sign the transaction. George uses a timer to show you how much time you have left. If this is too fast for you, you can request a new rate by clicking on "Update".

At the moment you can combine 21 currencies for the live rate with Euro with George: Australian Dollar, Bulgarian Leva, Canadian Dollar, Swiss Franc, Czech Koruna, Danish Krone, British Pound, Hong Kong Dollar, Croatian Kuna, Hungarian Forint, Japanese Yen, Mexican Peso, Norwegian Krone, New Zealand Dollae, Polish Zloty, Romanian Leu, Serbian Dinar, Swedish Krona, Singapore Dollar, US Dollar, South African Rand

You can execute an order with FX live rate if these four conditions are fulfilled:

Please note: No currency conversion is necessary if the order currency is the same as the account currency (e.g. an order in US dollars from a USD account).

You can request "live rate" information on bank business days 24 hours a day (however, there is a maintenance window from 07:00 - 07:15 a.m.) if you have the authorisation. Exceptions may be made on days such as New Year's Eve.

Within the scope of the authorisation, it is the final disposer (in the case of collective signing, the secondary signee) who requests and authorises the live rate. With the signing of the order, the final disposer also agrees to the displayed near-market live rate.

If you have signed an order with a live rate, George will show you a detailed overview with all the information about the order, such as the value in the account currency or the exchange rate. You can also find this information in the transaction history , which are also exported if you print out the transaction details.

Please note: Requesting and signing a live rate is ONLY possible in the George Business browser version, not with the George Business app. If you sign such an order in the app, the end-of-day rate (Erste Group Fixing) is used as the exchange rate.

Author: Samira El-Shamy