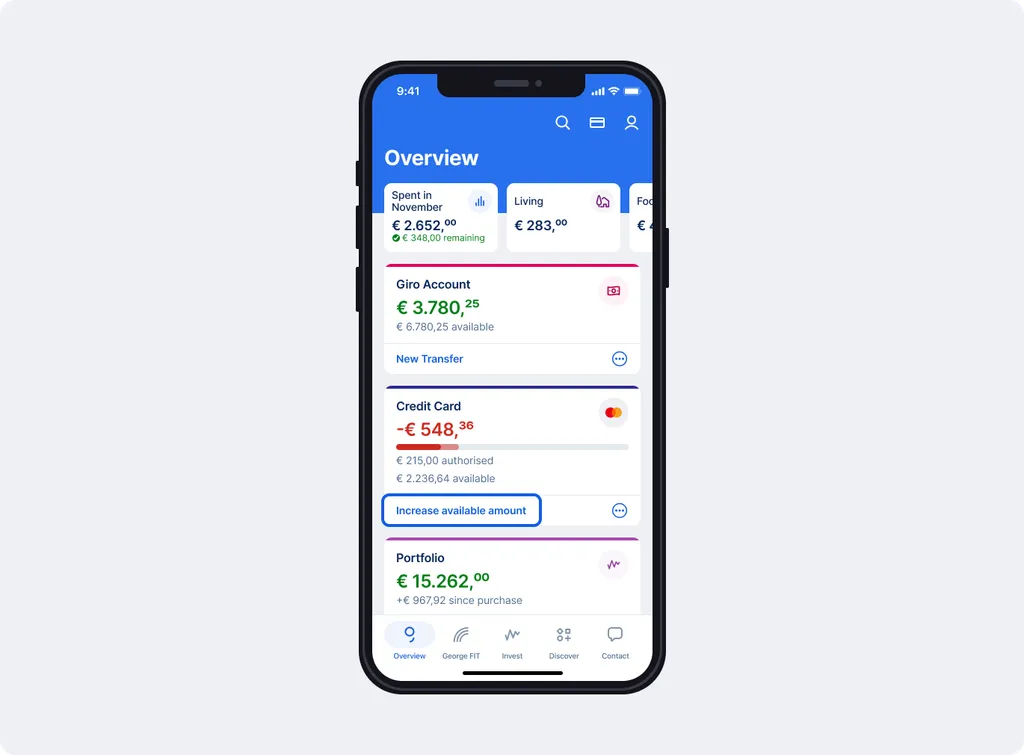

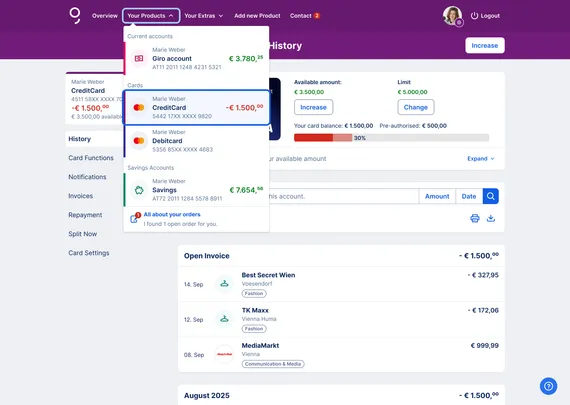

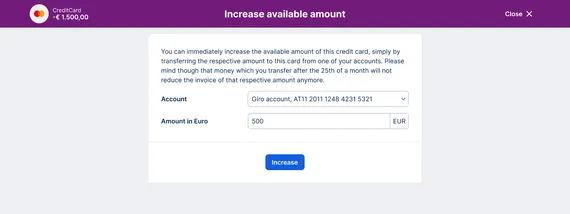

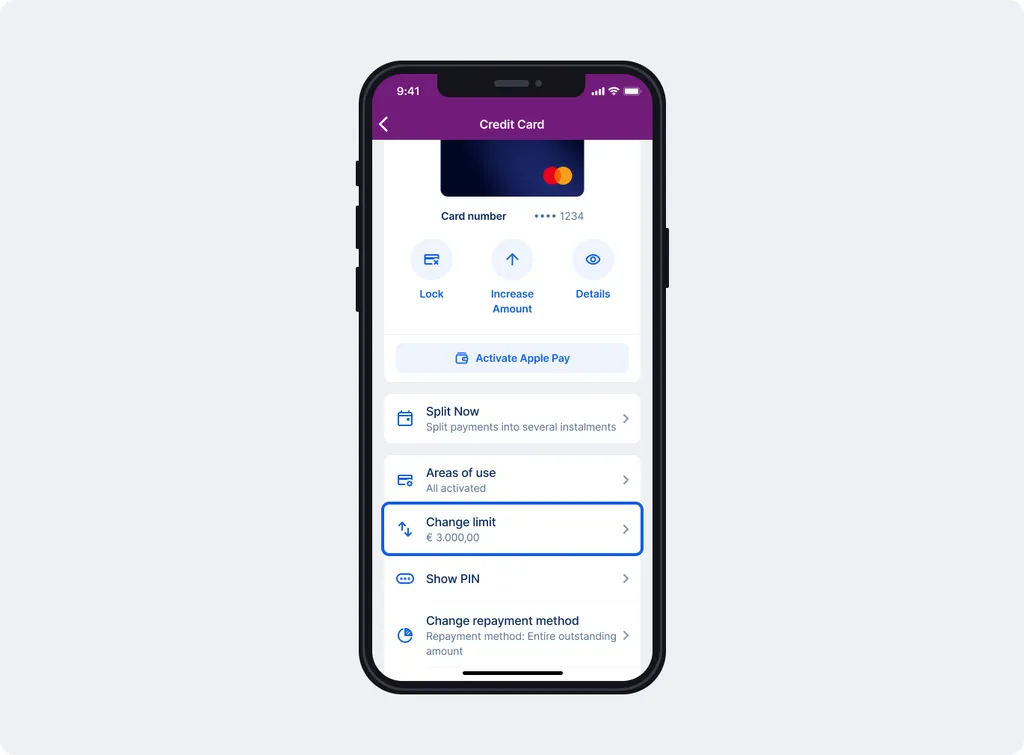

George lets you top up your available amount instantly by sending money from your current account. Basically, a transfer to your credit card. This can be handy if you’re near your limit. For example, if you've had some unexpected expenses come up. In comparison, your credit card limit is a fixed amount. It does not change when you raise your available amount.

Example: Let's say you have a € 1000 monthly limit. You've spent € 400 so far. Your available amount is € 600. If you raise it by € 500, you will have € 1100 to spend. When you buy something for € 600, it goes down to € 500.