Welcome to Business Virtualcards. Got an invite to use a virtual company credit card? This article shows you all you need to know as a future cardholder, from activation to using your card. Plus, practical features in the George app.

Last Article Update 16.07.2025

Welcome to Business Virtualcards. Got an invite to use a virtual company credit card? This article shows you all you need to know as a future cardholder, from activation to using your card. Plus, practical features in the George app.

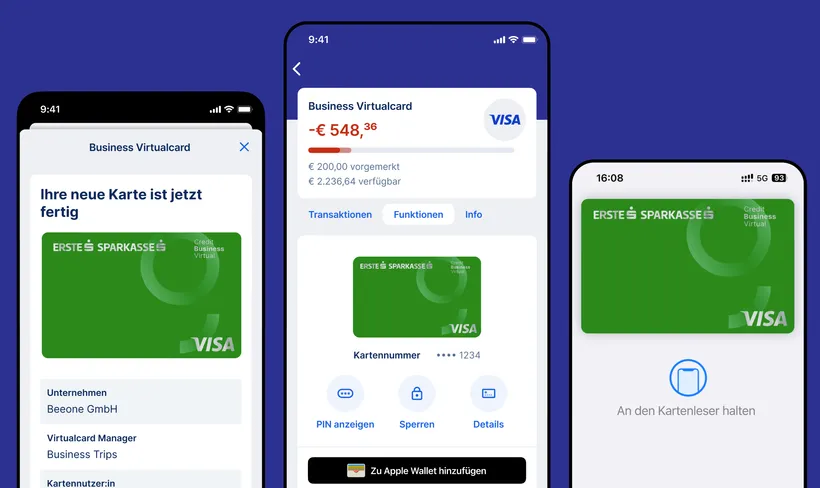

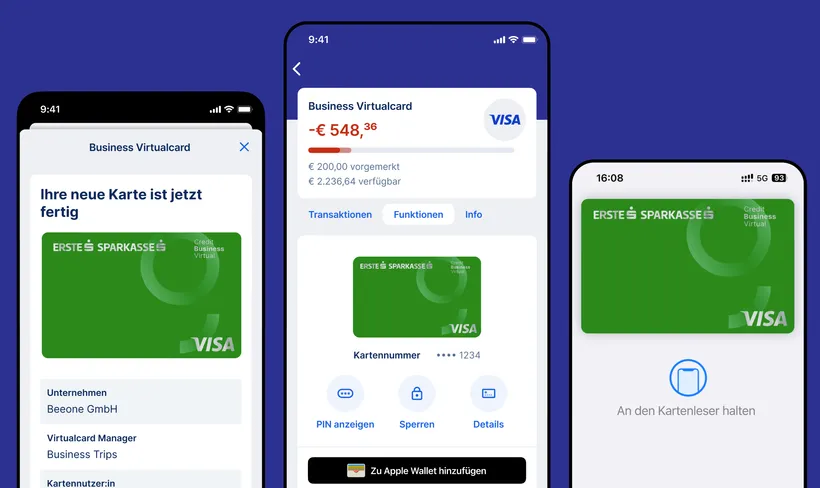

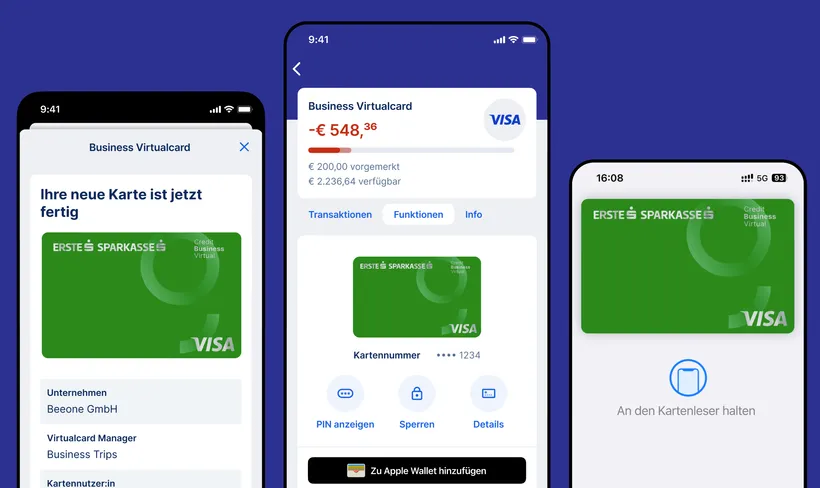

A Business Virtualcard is a virtual credit card that your company provides you for business payments, expenses and trips. Unlike a usual credit card, there is no physical (plastic) card. Business Virtualcards exist only in digital form on your phone or smart watch. This way, it's easy and safe to shop online, or make contactless payments in-store with Apple Pay or Google Pay.

With a Business Virtualcard, you can:

Make easy and contactless business payments

Manage your card hassle-free in the George app

See transactions any time you want

Lock your card (if needed) and add it to your Wallet

All you need is a phone that supports NFC (Near Field Communication).

As soon as your card administrator creates a card for you, you will get an invite e-mail. Here's what to do next, explained step by step.

Already have a George disposer ("Verfüger"), but your company is with a different bank institute? For example: Your company is an Erste Bank customer but you have an account with Tiroler Sparkasse?

If you have only one phone with George on it, there are a few more steps - that's because you need a disposer number ("Verfügernummer") at the same bank as your company, as well as a George QR activation code for your existing disposer ("Verfüger").

If you have a second phone without George (for example, a company phone), then get the George App for it from the relevant app store. Then, follow the steps for the onboarding.

We understand that this is not the ideal set-up, and are happy to help.

Here's how to proceed in such cases:

We're working full-speed on making this process simpler for you in the future.

Author: Tamara Berger-Feichter