From paying back a friend to paying a doctor's bill, transfers come in handy. But there's a limit. Find out why that's a good thing, as well as how to change your daily signing limit. Plus, what is and is not covered by it.

Last Article Update 17.07.2025

From paying back a friend to paying a doctor's bill, transfers come in handy. But there's a limit. Find out why that's a good thing, as well as how to change your daily signing limit. Plus, what is and is not covered by it.

Say you're moving into a nice new apartment. Yay! Now all you have to do is pay 3 months rent for the deposit.

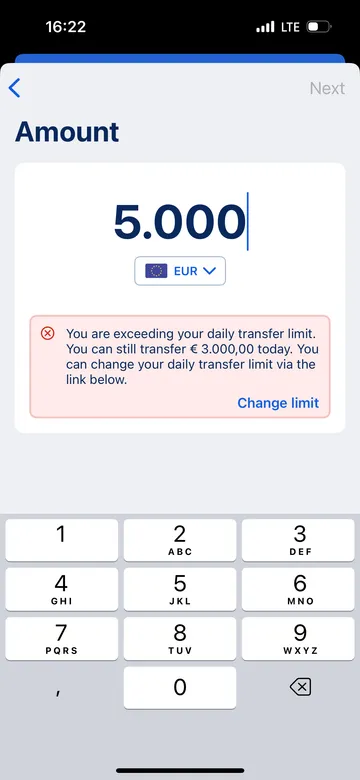

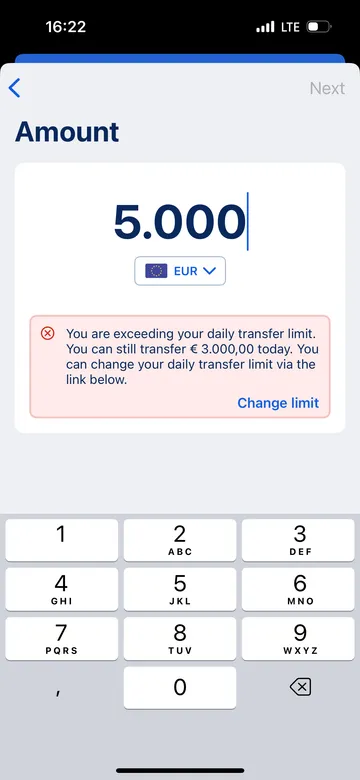

But when you try to transfer the money, George says you are exceeding your daily transfer limit. What does that mean? And what to do next?

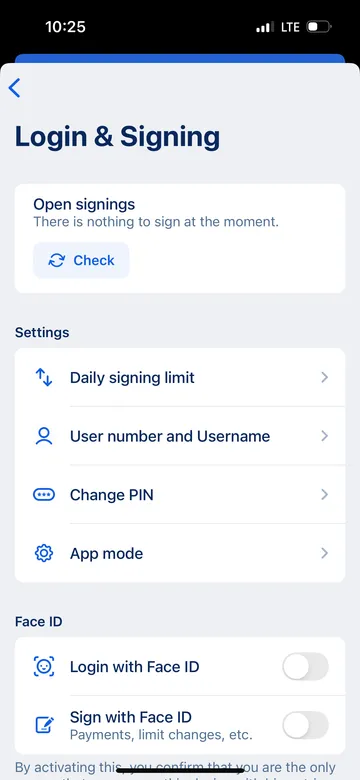

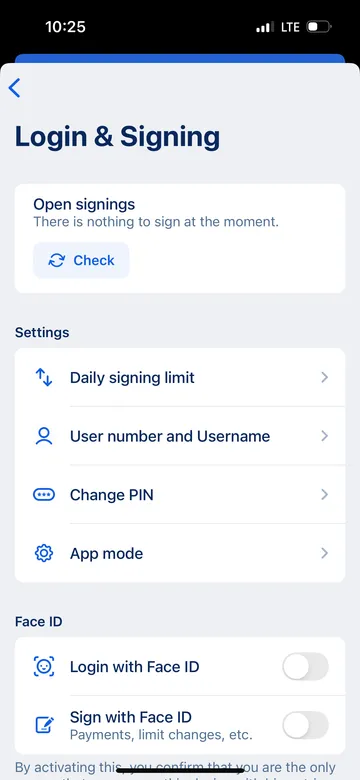

You set your daily signing limit when you first set up George ID. Easy to forget, especially if you did that long ago.

This explains why it's in Profile under "Login & Signing".

Signing with cardTAN? By default, you won't have a limit, but you can set one any time you want.

Think of your daily signing limit as how much you can transfer per day across all your current accounts. This helps keep your money safer by limiting loss in case of fraud.

In other words, it covers one-off transfers, whether local or international.

Keep in mind that the following do not count toward your limit:

So far, so good. But what if you do need transfer more money? Glad you asked. The rest of this article shows you how.

In general, it's good to keep your limit as low as needed - enough to cover expected costs. George warns you if you try to go above 3000 €. You can raise it on days you have to make more transfers, then lower it again later.

Remember, daily signing limit does not include payments or withdrawals using your card. It also does not include regular expenses you make with standing orders, such as:

You can also send money to yourself - for example, to a savings account - and this will also not go out of your limit.

Basically, the daily signing limit is for SEPA and non-SEPA transfers that do not repeat.

Author: Charles Wagner