With George it's not only easy to create transfers of any kind but also to collect money from someone else - so-called SEPA direct debits. In the following article, you'll find out everything you need to know about SEPA direct debits and how you can create them with a little help from George.

Create New SEPA Direct Debit as a Creditor

Last Article Update 11.03.2025

Though it sounds appealing to ask George to collect money from others for you, he is only able to do so under certain conditions. There are some reasons why somebody would like to set up a SEPA direct debit. For example, if you are a property owner and want to retrieve the rent from your tenants. As your account is not automatically enabled to create SEPA direct debits, please talk to your advisor if you want to set up SEPA direct debit and what requirements you must fulfil.

You can download the blank SEPA direct debit form as a template here.

How to set up a SEPA direct debit:

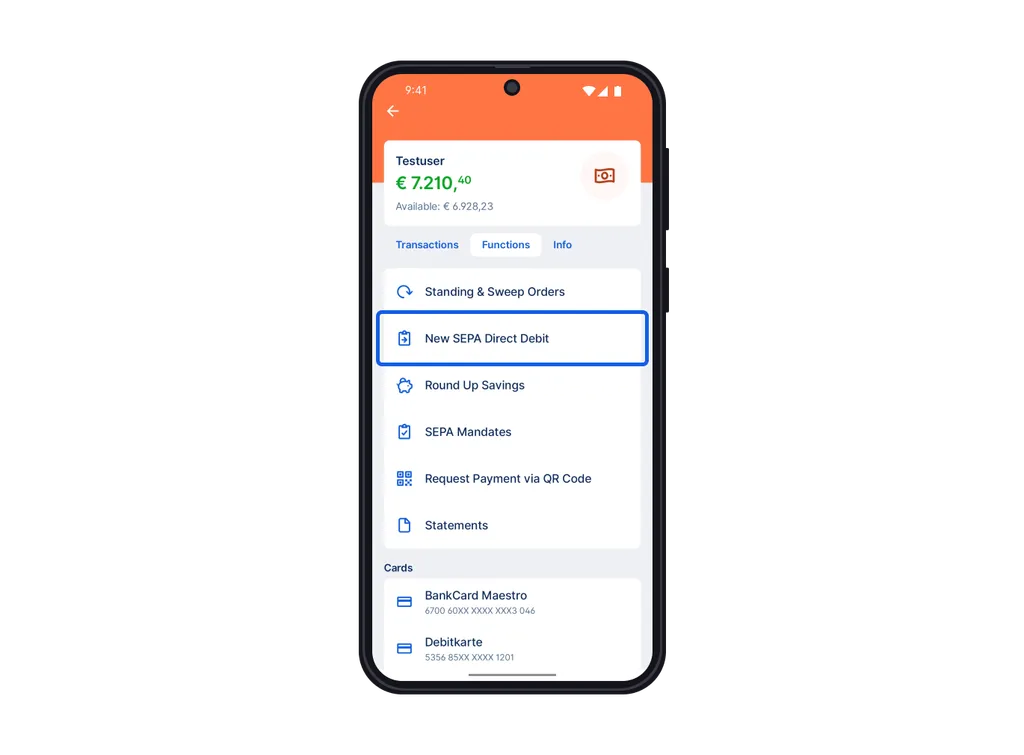

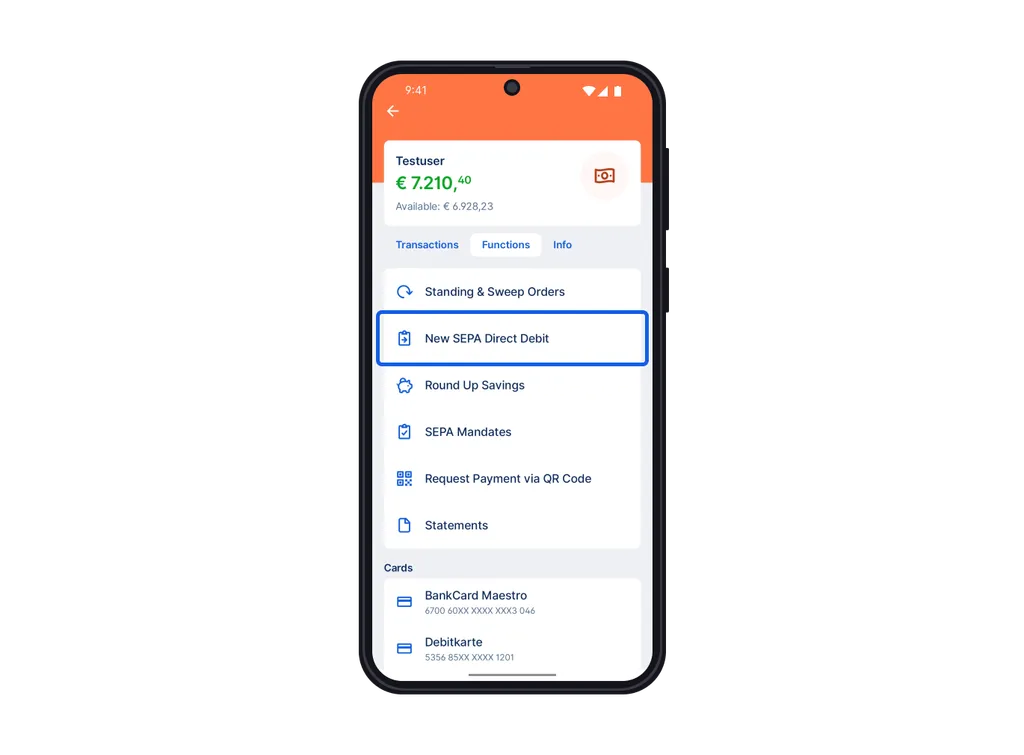

1. Tap on the account you want to set up a SEPA direct debit with.

2. Go to "Functions" on the top of the screen. There you will find the item "New SEPA Direct Debit". Tap on it.

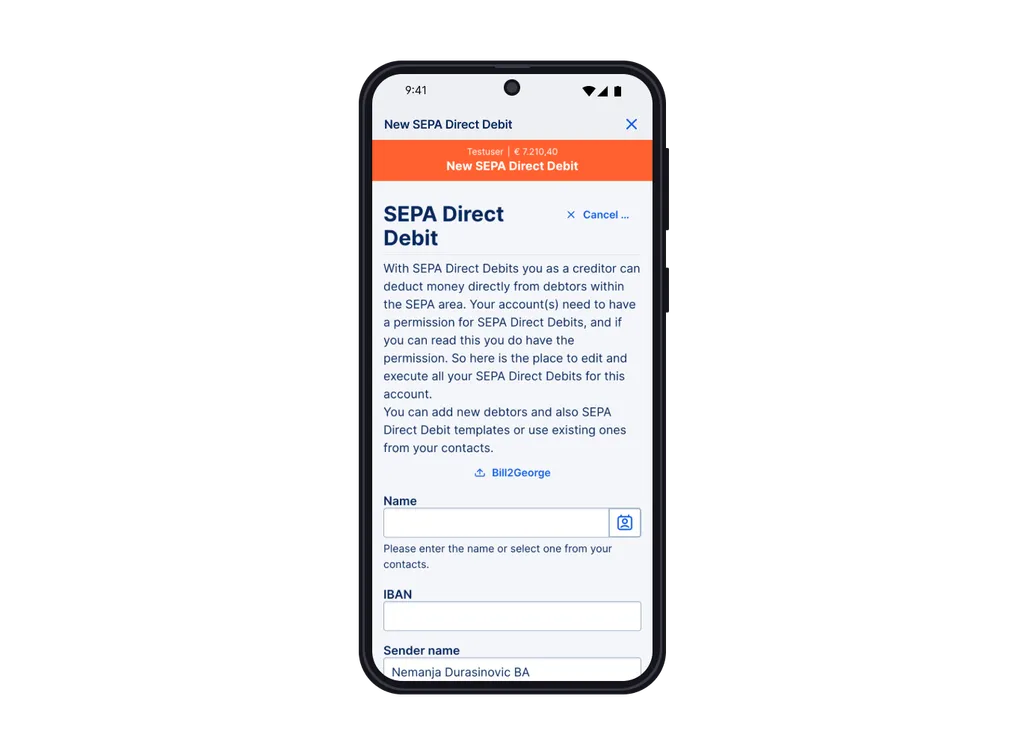

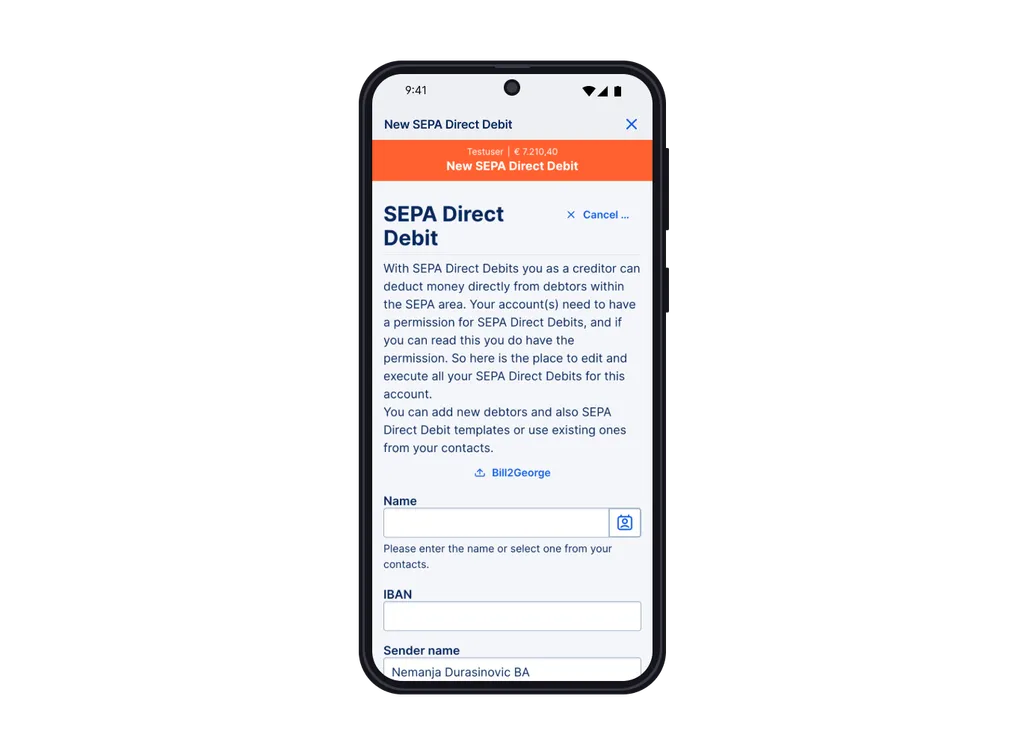

3. Enter the debtor's name and the amount. Please make sure that you do have a signed and valid SEPA mandate of the debtor.

4. In the next step, enter the mandate ID. The mandate ID is a unique identification number for your direct debit and is set by you in advance and sent to your customer on the contract, which makes it easy for them to see the reason for the direct debit. It is an identification number that will remain the same every time you execute the direct debit - at least if it is based on the same contract between you and your customer when you initiate the direct debit. You can also use multiple mandate IDs per customer if you have multiple contracts. For example, large energy suppliers often have two mandates for a customer who buys two products from them, e.g. one for gas and one for electricity.

The mandate ID must only be a maximum of 35 characters long and can contain ciphers (0-9), letters (A-Z), the following symbols: / - ? : ( ) . , ' and a space.

5. The item "SEPA direct debit type" refers to two possible types, SEPA direct debit CORE and SEPA direct debit B2B. SEPA direct debit CORE allows direct debits from private and corporate customers but has a time limit for recalculation. An authorised SEPA core direct debit (which requires a valid mandate) can be returned to the sender within 56 days after it has been debited, i.e. the account debit is reversed. In the case of an unauthorised direct debit (i.e. if there is no valid mandate), the debit can be recalled within 13 months. This is stipulated by the Payment Services Act.

B2B, direct debits, however, can only be collected from company accounts, the mandate must also be disclosed in advance to both bank sides (creditor and debtor) with the supervisor so that it is released. However, B2B SEPA direct debits have no recalculation option.

6. The Date of Signature is the date when the debtor signed the SEPA direct debit mandate, most likely in the course of signing the corresponding contract. I will provide the date of signature for each and every recurring direct debit with the same mandate ID. You can download an example form next to the "date of signature" field.

7. Under "Transfer Type" you can select whether the direct debit is

- a recurring direct debit (default setting), meaning this is a direct debit that you will execute regularly (e.g. a fitness center membership fee).

- a first-time direct debit for the very first direct debit of an upcoming series. You might choose this option if you plan to execute more than one direct debit using the same mandate in the near future, so I will keep the mandate in my memory for you. However, all first-time direct debits automatically change into recurring direct debits after executing them. Thus, you might choose my default setting, a recurring direct debit, right away, even for a first-time direct debit.

- a last-time direct debit which I will recognize as the termination of the direct debit for this mandate. After this last execution, I will free the mandate ID for another customer/contract.

- or a one-time direct debit if you want to use it only one single time (e.g. an online shopping portal where users make purchases on an irregular basis). After this single execution, I will free the mandate ID for another customer/contract.

8. If you want, you can then edit the Creditor ID. You can change the "Business Area Code" part of the Creditor ID. However, if you don't know what to fill in here, keep the prefilled ZZZ.

9. In the next steps, you can enter either a text or a payment reference as well as a sender reference and also select the execution date. If you don't enter a specific date, George will execute the SEPA direct debit as soon as possible.

10. You can also save this SEPA direct debit as a template, as any other order, by clicking the "Template" checkbox.

11. When the SEPA direct debit is good to go, you can click either "Save & new" or sign it right away.

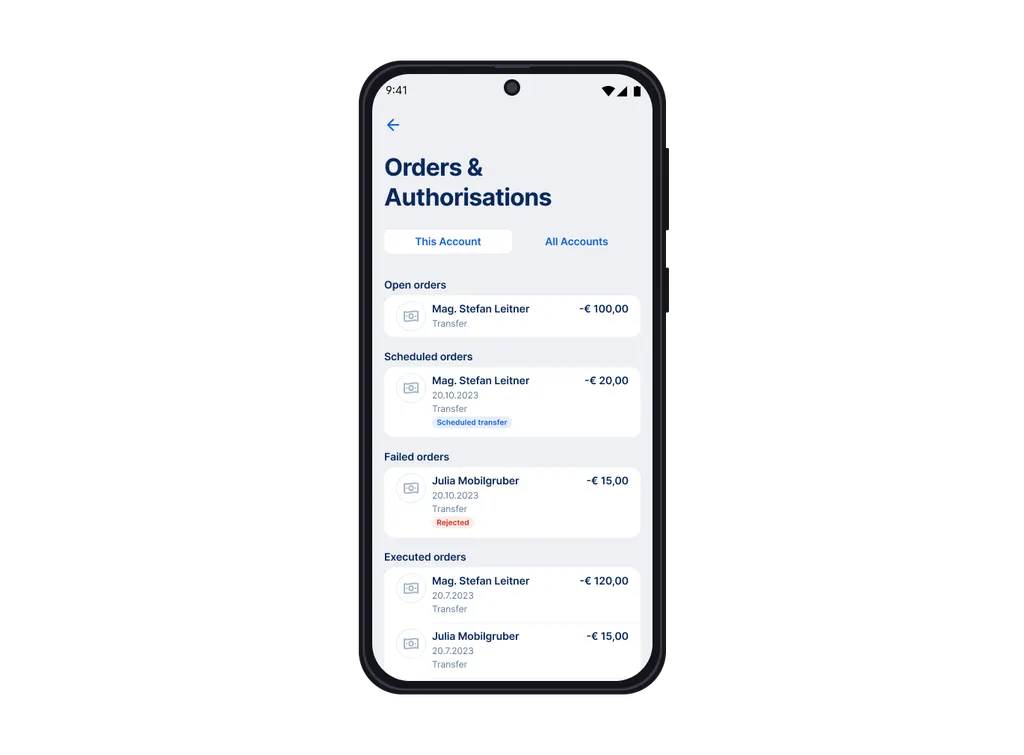

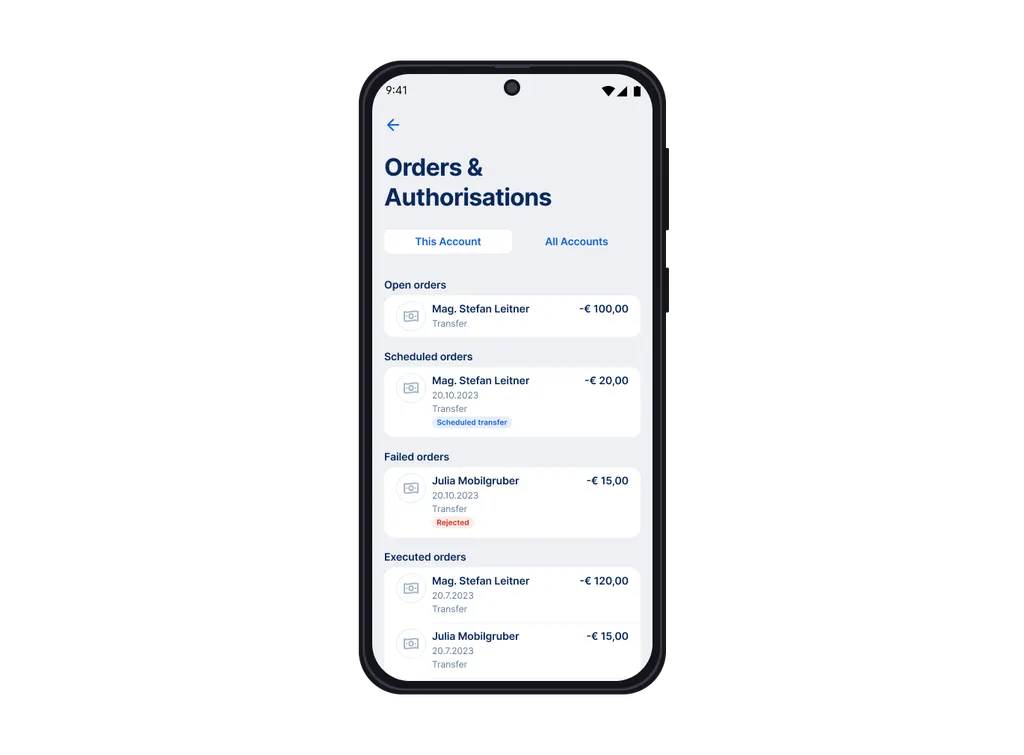

As soon as you've signed your order, you can see it under "Orders & Authorisations".

You will find it by tapping on the account from which you have set up the SEPA direct debit and then tap on "Orders & Authorisations" in the upper area of the screen.

1. In your overview, click on the account from which you want to create a SEPA direct debit.

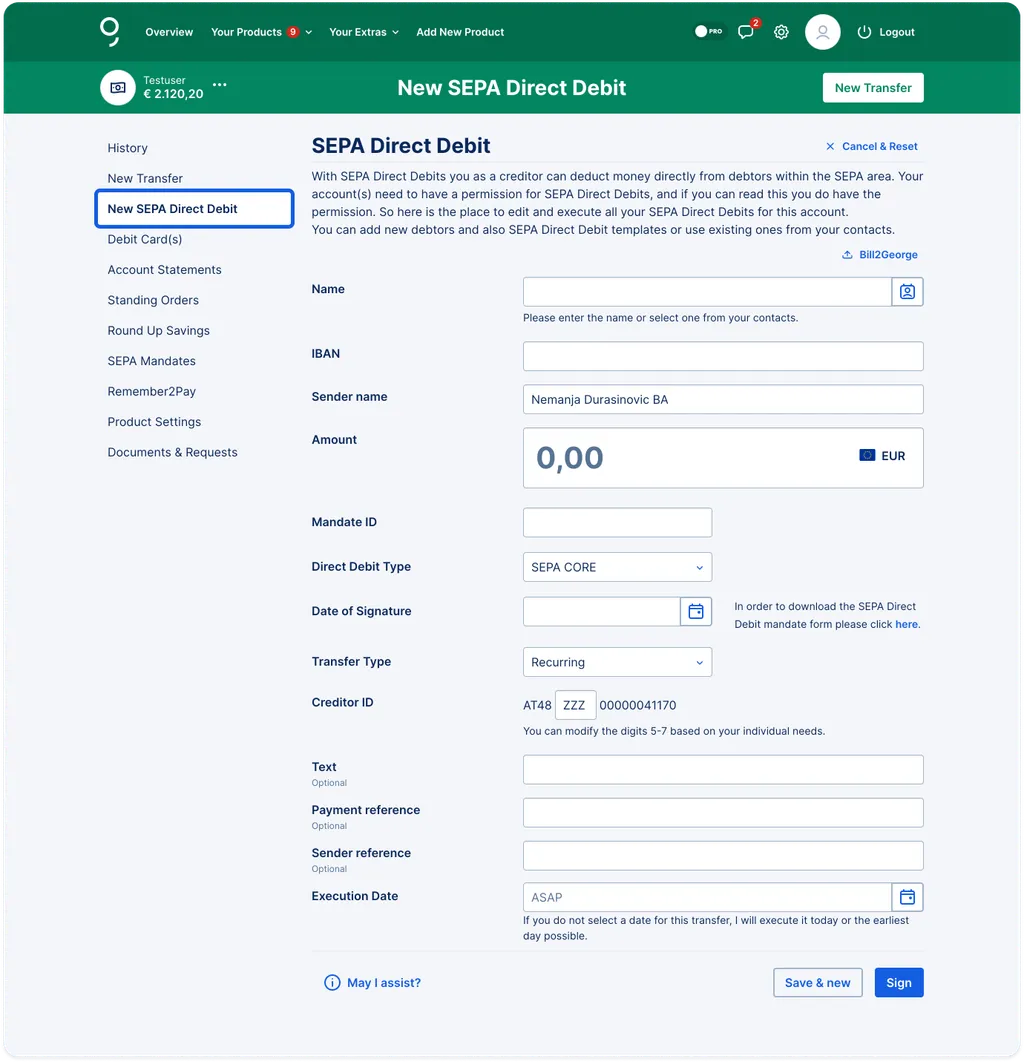

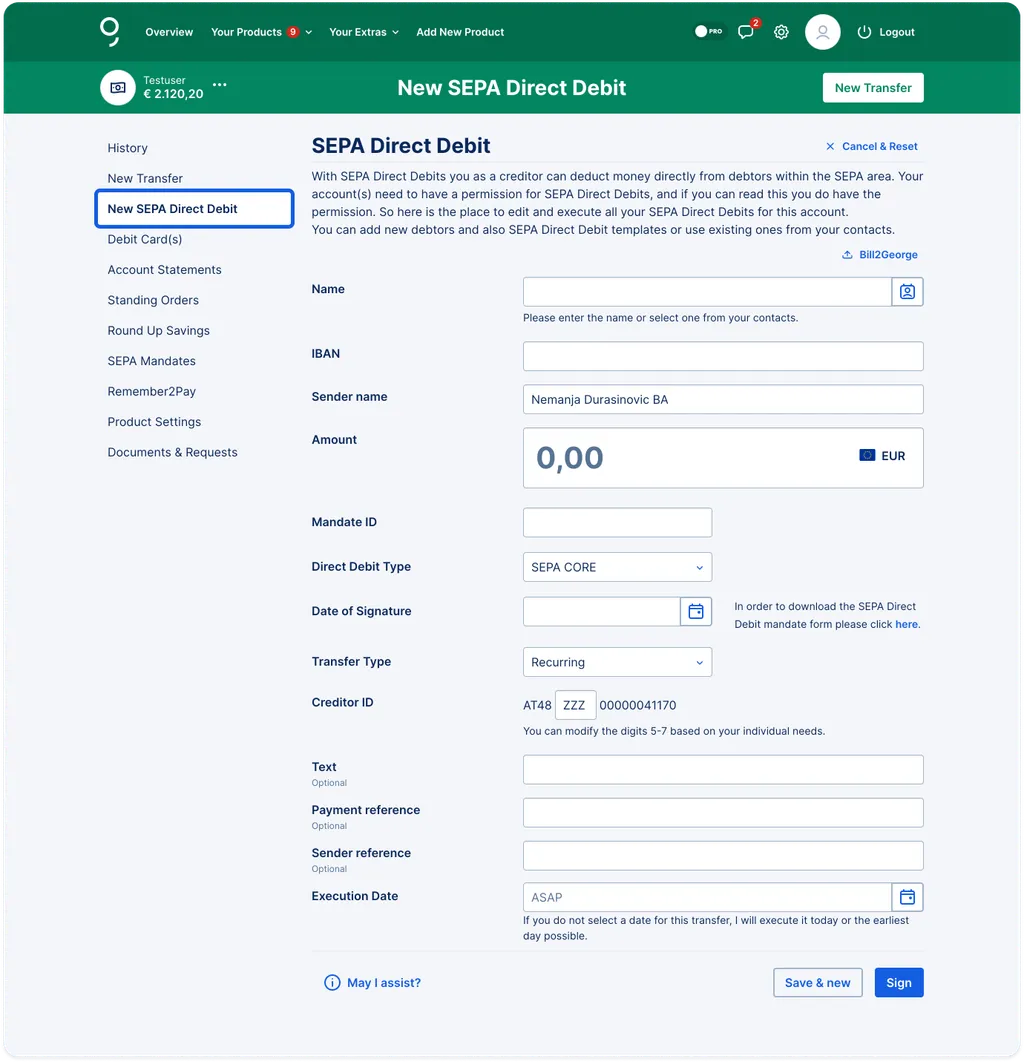

2. In the menu on the left side, you will find the item "New SEPA Direct Debit", i.e. if your account has the permission to create SEPA direct debits. Click on it.

3. Enter the debtor's name and the amount. Please make sure that you do have a signed and valid SEPA mandate of the debtor.

4. In the next step, enter the mandate ID. The mandate ID is a unique identification number for your direct debit and is set by you in advance and sent to your customer on the contract, which makes it easy for them to see the reason for the direct debit. It is an identification number that will remain the same every time you execute the direct debit - at least if it is based on the same contract between you and your customer when you initiate the direct debit. You can also use multiple mandate IDs per customer if you have multiple contracts. For example, large energy suppliers often have two mandates for a customer who buys two products from them, e.g. one for gas and one for electricity.

The mandate ID must only be a maximum of 35 characters long and can contain ciphers (0-9), letters (A-Z), the following symbols: / - ? : ( ) . , ' and a space.

5. The item "SEPA direct debit type" refers to two possible types, SEPA direct debit CORE and SEPA direct debit B2B. SEPA direct debit CORE allows direct debits from private and corporate customers but has a time limit for recalculation. An authorised SEPA core direct debit (which requires a valid mandate) can be returned to the sender within 56 days after it has been debited, i.e. the account debit is reversed. In the case of an unauthorised direct debit (i.e. if there is no valid mandate), the debit can be recalled within 13 months. This is stipulated by the Payment Services Act.

B2B, direct debits, however, can only be collected from company accounts, the mandate must also be disclosed in advance to both bank sides (creditor and debtor) with the supervisor so that it is released. However, B2B SEPA direct debits have no recalculation option.

6. The Date of Signature is the date when the debtor signed the SEPA direct debit mandate, most likely in the course of signing the corresponding contract. I will provide the date of signature for each and every recurring direct debit with the same mandate ID. You can download an example form next to the "date of signature" field.

7. Under "Transfer Type" you can select whether the direct debit is

- a recurring direct debit (default setting), meaning this is a direct debit that you will execute regularly (e.g. a fitness center membership fee).

- a first-time direct debit for the very first direct debit of an upcoming series. You might choose this option if you plan to execute more than one direct debit using the same mandate in the near future, so I will keep the mandate in my memory for you. However, all first-time direct debits automatically change into a recurring direct debit after executing them. Thus, you might choose my default setting, a recurring direct debit, right away, even for the first-time direct debit.

- a last-time direct debit which I will recognize as the termination of the direct debit for this mandate. After this last execution, I will free the mandate ID for another customer/contract.

- or a one-time direct debit if you want to use it only one single time (e.g. an online shopping portal where users make purchases on an irregular basis). After this single execution, I will free the mandate ID for another customer/contract.

8. If you want, you can then edit the Creditor ID. You can change the "Business Area Code" part of the Creditor ID. However, if you don't know what to fill in here, keep the prefilled ZZZ.

9. In the next steps, you can enter either a text or a payment reference as well as a sender reference and also select the execution date. If you don't enter a specific date, George will execute the SEPA direct debit as soon as possible.

10. You can also save this SEPA direct debit as a template, as any other order, by clicking the "Template" checkbox.

11. When the SEPA direct debit is good to go, you can click either "Save & new" or sign it right away.

As soon as you signed your order, you can see it in your order list.

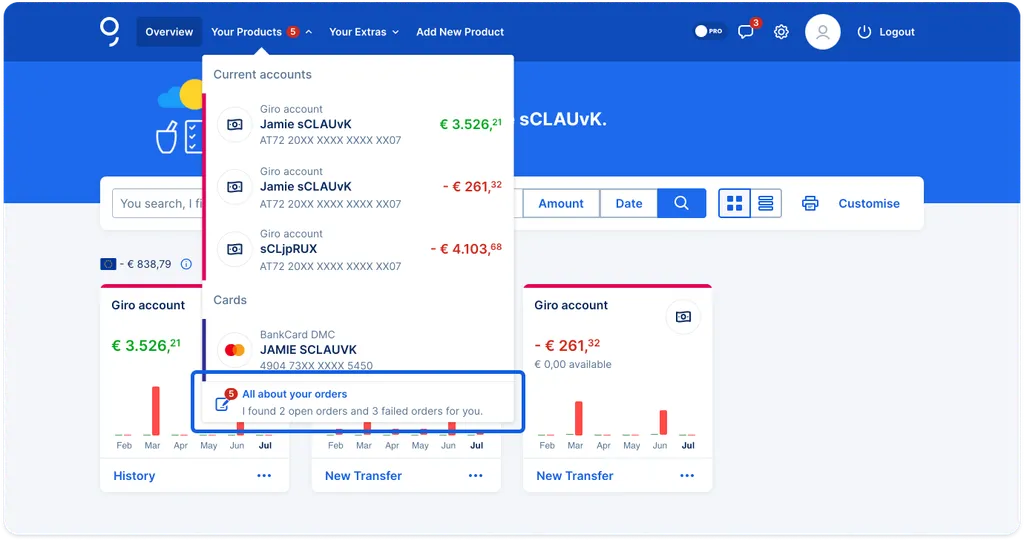

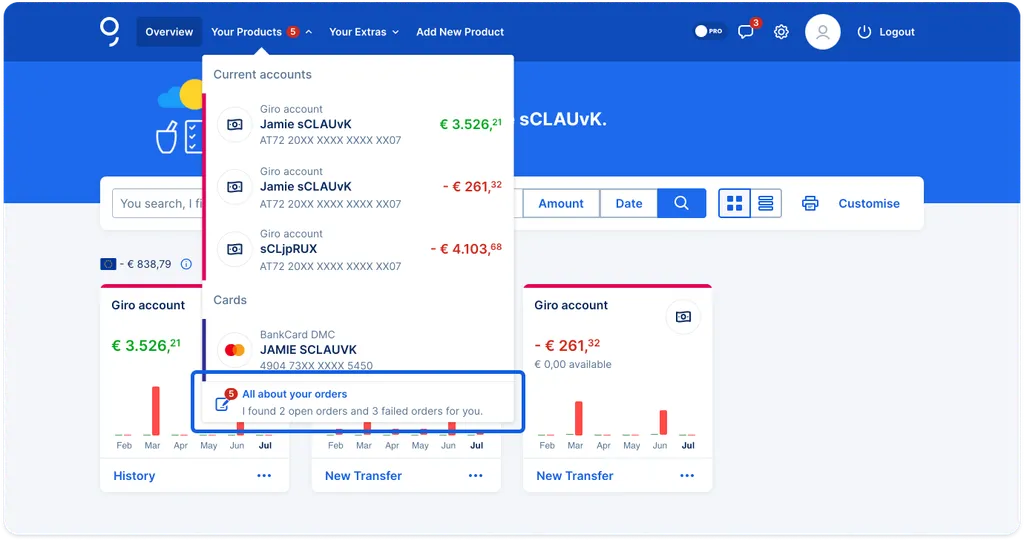

You will find it by navigating to "Your Products" at the top of your overview and then, at the bottom, you'll find the item "All about your orders". Your SEPA direct debit will be listed under "Executed orders".

Author: Samira El-Shamy