Your working capital is one of the key factors for your business' success. With his Working Capital Simulator in the Financial Health Zone, George Business is helping you assess and improve your working capital situation and set free liquidity.

Last Article Update 16.04.2025

Your working capital is one of the key factors for your business' success. With his Working Capital Simulator in the Financial Health Zone, George Business is helping you assess and improve your working capital situation and set free liquidity.

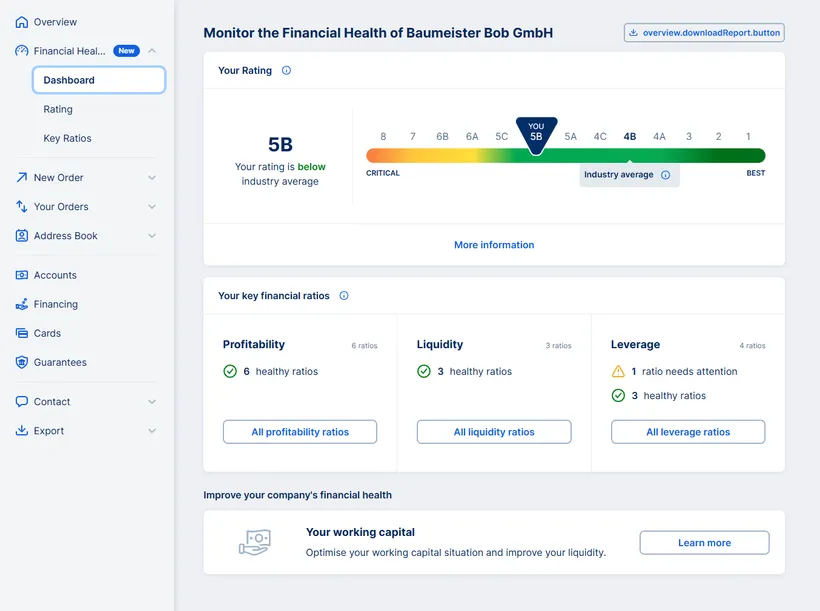

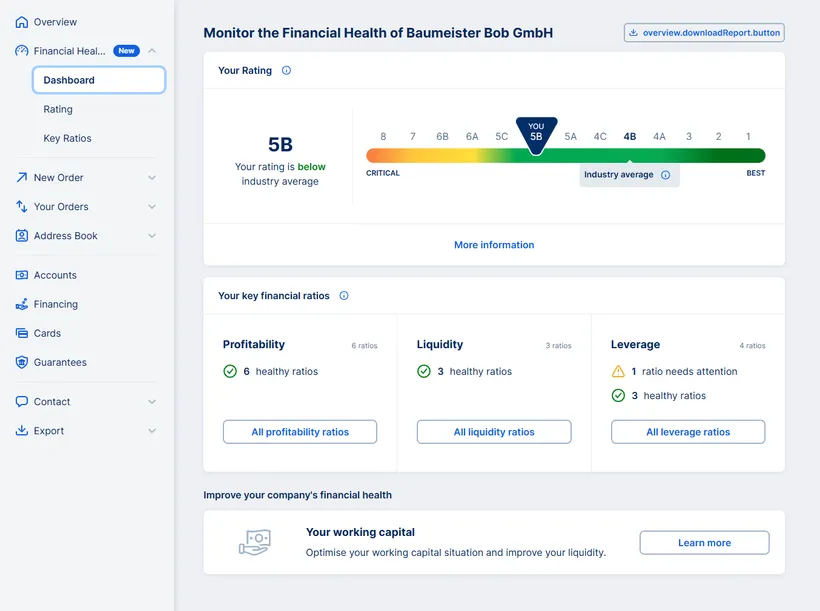

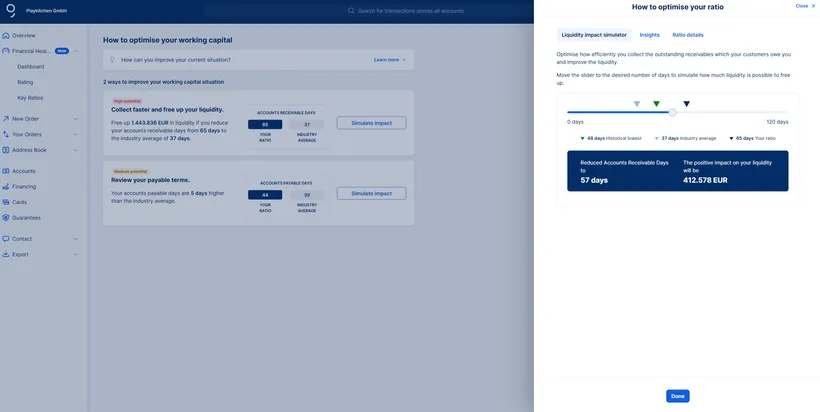

In the overview of your George Business Financial Health Zone, you’ll find the entry point "Your Working Capital".

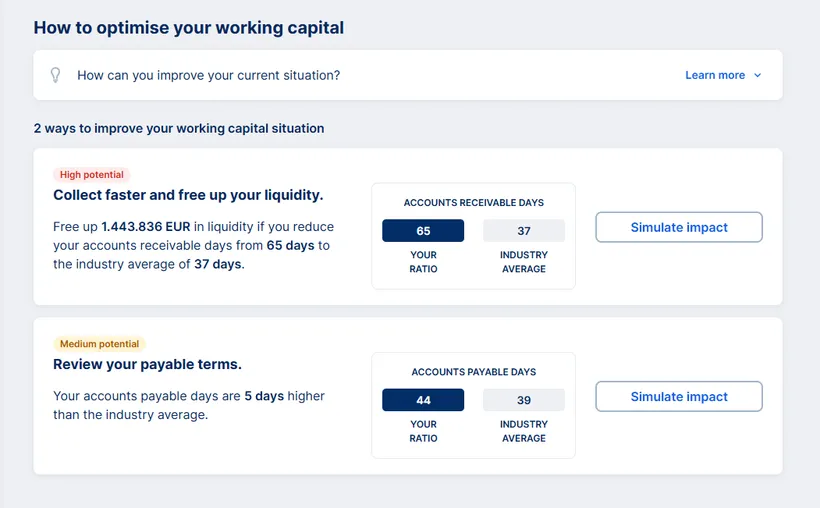

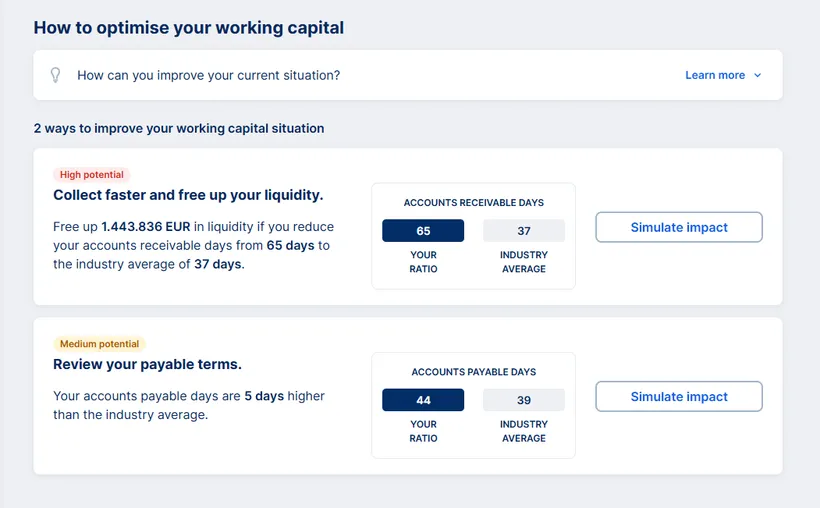

George breaks down your working capital situation based on your latest balance sheet figures into three key ratios that impact your company’s liquidity:

Accounts Receivable Days: This focuses on potential improvements in receivables management. By accelerating customer payments, you can free up liquidity.

Accounts Payable Days: Review your payment terms and optimise the timing of your outgoing payments. Don’t pay invoices "too early," but make sure to take advantage of any early payment discounts.

Inventory Turnover Days: Review your inventory levels and consider whether they can be reduced. Excess inventory ties up capital that could be better used elsewhere in your daily operations.

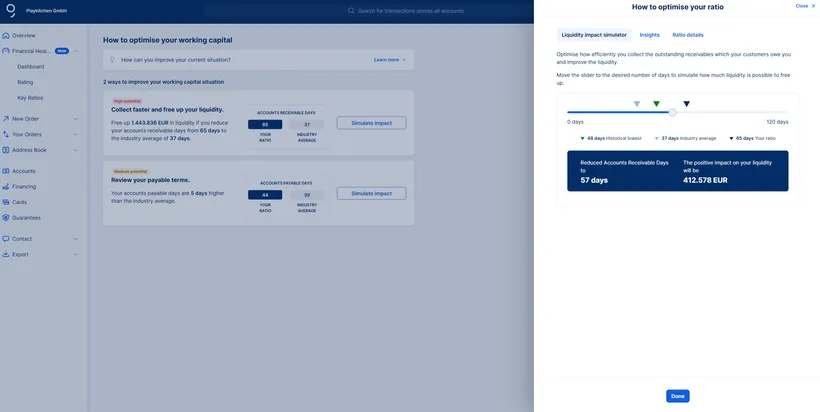

Afterwards, you can simulate the impact of changes to each ratio — for example, by adjusting the slider to reduce the accounts receivable days. George Business instantly displays how these changes affect your company’s liquidity.

Naturally, you’ll also have access to detailed insights into these key ratios, including how your indicators stack up against the industry average.

With the new Working Capital Simulator, George Business provides you with concrete support in improving your working capital situation. This enables you to take steps that strengthen your company’s financial health.

Author: Dag Erik Zimen