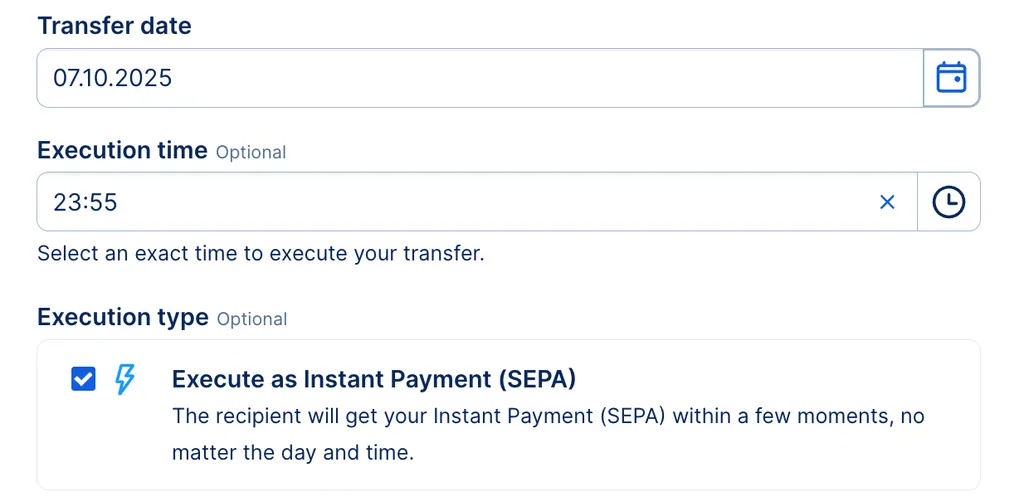

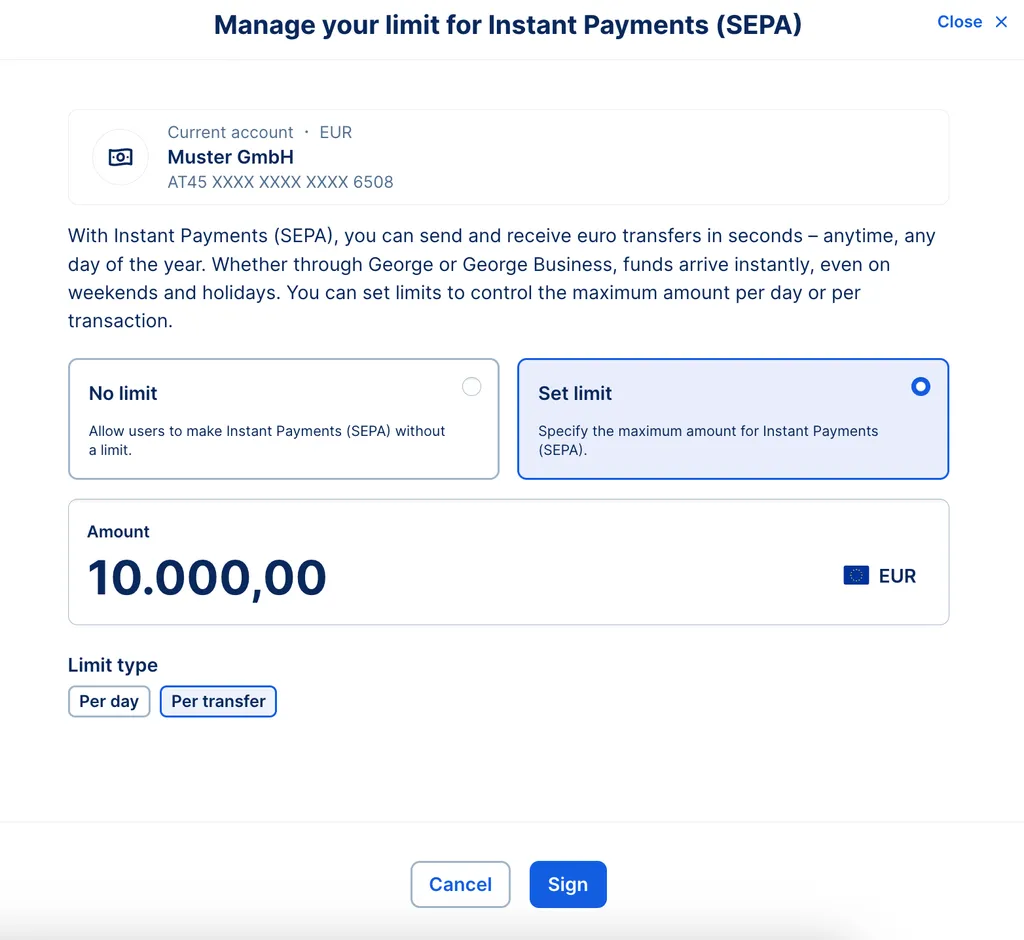

Instant Payments (SEPA) let you transfer money fast, around the clock. That way, you get to decide exactly when to move your money. With the EU Instant Payments Regulation (IPR), active as of 09/10/2025, you can set an individual limit for Instant Payments (SEPA). This helps you stay on top of what goes out of your company accounts.