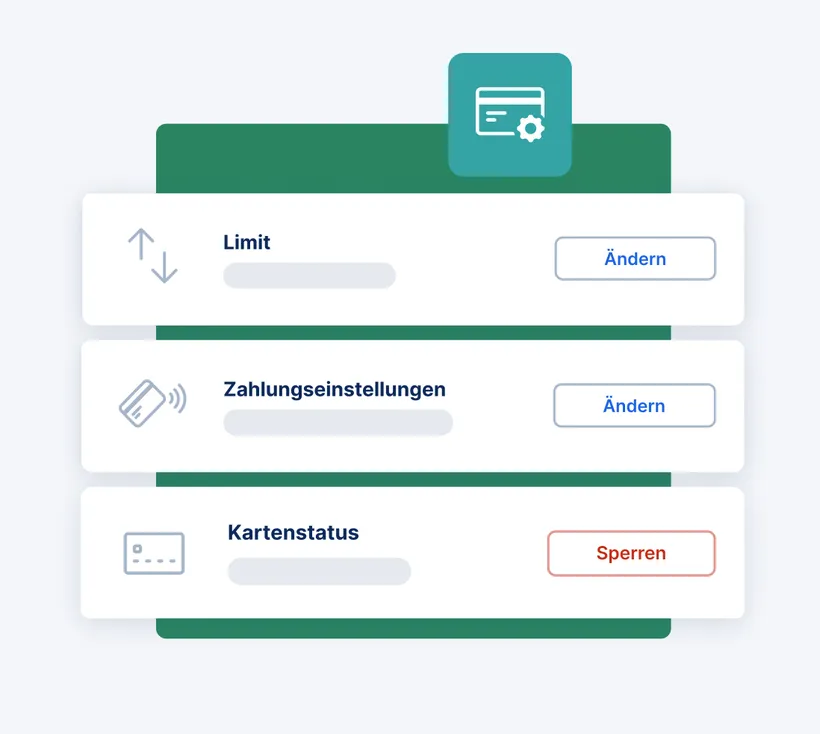

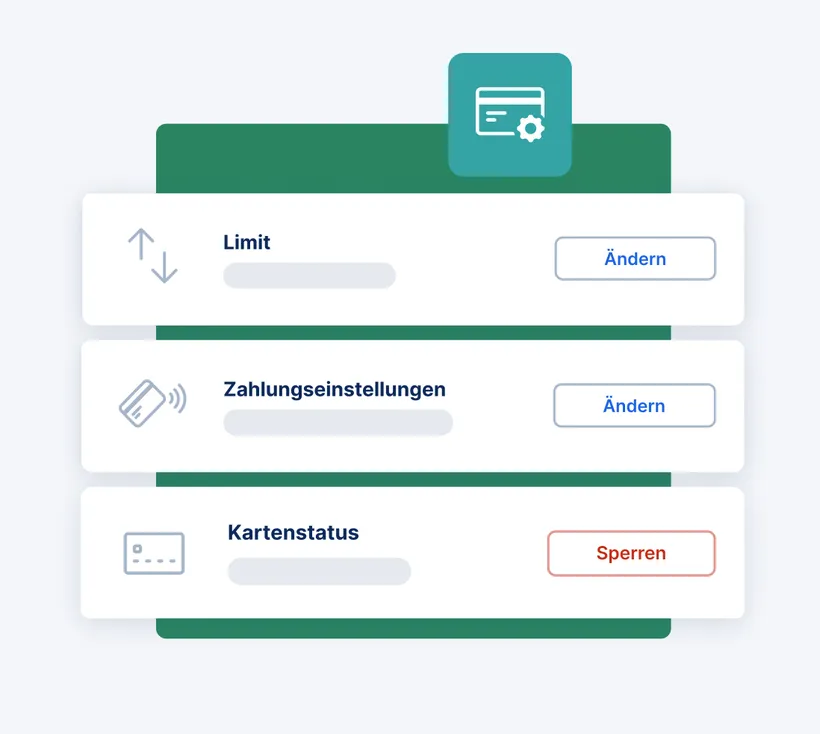

Virtual company credit cards have many benefits for your employees - faster payments, less paperwork, more flexibility for the business. Here you'll find practical advice, tips and useful information about using Virtualcard Manager with George Business - from your first order to successfully inviting your employees.